Car Prices Set to Surge as Automakers Brace for Tariffs

The auto finance industry is facing a significant challenge: tariffs. With new 25% tariffs on vehicle imports from Canada and Mexico, lending institutions, auto dealerships, and financial companies that provide vehicle financing must prepare for increased costs, shifting default rates, and changing repossession dynamics. How will this reshape vehicle financing, and what steps should lenders take to adapt?

Tariffs Drive Up Costs, Impacting Auto Lenders

President Trump’s tariff policies have sent shockwaves through the automotive sector, disrupting an industry dependent on cross-border trade. With nearly $225 billion in trade at stake, lenders, dealerships, and finance companies are bracing for the financial ripple effects. Tariffs are expected to add around $60 billion in costs, much of which will be passed through the supply chain, ultimately increasing vehicle prices and loan amounts.

Financial institutions relying on auto lending will see increased risk exposure. Higher vehicle prices lead to larger loan amounts, which in turn increase the likelihood of defaults. "The auto sector is going to shut down within a week," warned Flavio Volpe, president of Canada’s Automotive Parts Manufacturers’ Association. At 25% tariffs, maintaining profitability in lending portfolios becomes significantly more challenging. Financial institutions across the auto lending sector, including subprime lenders, captive finance companies, and buy-here-pay-here (BHPH) dealerships, are closely monitoring these developments, assessing how increased loan balances and potential depreciation could affect repayment rates.

Economic Fallout – Could Lending Markets Take a Hit?

The impact of tariffs isn’t just about higher car prices—it’s about the financial institutions that support vehicle purchases. Lenders serving subprime and title loan markets could experience increased defaults as borrowers struggle to afford higher monthly payments. Dealers that offer in-house financing may find themselves taking on higher-risk customers, leading to a rise in repossessions and charge-offs.

Ontario Premier Doug Ford warned that Canada’s most populous province could lose over 500,000 jobs, many tied to the auto sector. For auto lenders, job losses translate to greater financial instability for borrowers, increasing delinquencies across the industry. Meanwhile, car components can cross US borders up to eight times before final assembly. New tariffs disrupt this intricate process, adding costs at every stage and further increasing vehicle depreciation risk.

Supply Chain Disruptions and Repossession Concerns

With tariffs in play, automakers and financial institutions must navigate uncertain supply chains. Auto lenders should prepare for higher vehicle costs to impact depreciation schedules and collateral values. A $3,000 price increase on vehicles doesn’t just affect buyers—it changes the entire financing equation, requiring lenders to reassess risk models, loan-to-value ratios, and asset recovery strategies.

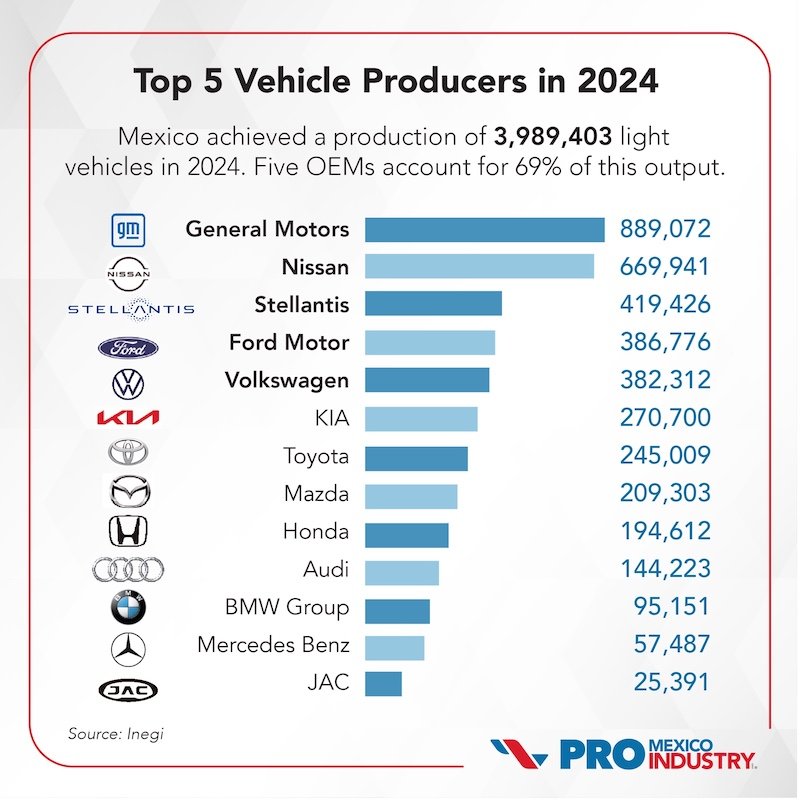

Adding another layer to the crisis, the US government has expressed concerns about China using Mexico as a “backdoor” for cheaper goods to enter the US market. While some experts argue this concern is exaggerated—less than 3% of auto components in Mexico come from China—policymakers are closely monitoring the situation. Meanwhile, Mexican President Claudia Sheinbaum has imposed her own tariffs on Asian imports to counteract the effect.

Auto Lenders’ Response – Adapting to New Realities

Facing financial strain, auto finance companies are implementing several strategies to navigate this crisis:

Reassessing risk models: Lenders must adjust loan terms to account for increased vehicle costs and potential depreciation risks.

Strengthening repossession strategies: With higher default rates on the horizon, lenders must refine recovery processes to mitigate losses.

Evaluating collateral values: Loan-to-value (LTV) ratios must be adjusted to reflect changing market conditions.

Diversifying portfolios: Expanding lending options beyond traditional auto loans could help lenders mitigate exposure to high-risk segments.

General Motors Financial and Ford Credit are closely monitoring these developments. "Many of these actions are no cost or low cost. What we won’t do is spend large amounts of capital without clarity," said GM CEO Mary Barra. Meanwhile, subprime lenders and title loan providers are evaluating their lending models to mitigate default risks.

The Future of Auto Lending and Recovery

Since Trump renegotiated the US-Mexico-Canada Agreement (USMCA), auto lenders have largely avoided major disruptions—until now. The introduction of new trade duties could upend vehicle financing, increasing loan amounts and reducing affordability for borrowers. Higher monthly payments could drive delinquencies and repossessions, pushing financial institutions to strengthen recovery strategies.

Experts warn that achieving self-sufficiency in auto manufacturing is easier said than done. While Trump's trade policies aim to shift production back to the US, the reality is that rebuilding domestic supply chains would take years and substantial investment. In the meantime, lenders will need to prepare for market fluctuations and potential downturns in the used car market.

Meanwhile, Canada and Mexico are considering retaliatory tariffs, further complicating North America’s trade landscape. Prime Minister Justin Trudeau has signaled that Canada may impose 25% tariffs on $106 billion worth of US goods in response, while Sheinbaum has promised countermeasures to protect Mexico’s economy. These developments could further strain the auto lending market and require financial institutions to adjust their lending strategies accordingly.

The road ahead remains uncertain for auto lenders. Increased vehicle prices, supply chain disruptions, and evolving trade policies will challenge financial institutions that provide vehicle loans. Higher default rates and greater repossession risks will require lenders to refine their risk models and asset recovery strategies.

As the industry adapts to shifting trade policies, financial institutions must stay informed and proactive. Whether by adjusting loan terms, leveraging advanced repossession technology, or diversifying lending portfolios, lenders that prepare now will be better positioned to navigate this evolving market. The coming months will be crucial in determining how tariffs reshape North America's auto finance landscape.